Once a person begins their life away from their childhood home and contemplates buying their first home, they are bombarded with the confusing housing market, inconsistent adjustable-rate mortgages (ARMs), FHA regulations, and plenty of other bewildering acronyms. Picking your new home is a huge commitment, and it comes with a variety of other decisions along the journey. Everyone knows the inevitables in life, death and taxes, and yet, we seem to miss the importance of the third: the decision to rent or own.

Money drives every individual’s decision. The housing market is often inconsistent, making it difficult to know which home to commit copious amounts of payments towards. Various aspects contribute to the decision itself as well, like the environment and society.

Rob Ellerman, licensed real estate agent, who happens to represent some Kansas City Chiefs rookies, takes a specific approach to the question. As his occupation focuses on home ownership, he pushes for clients to put a down payment on a home. “I obviously am biased to the point you should always own a house,” Ellerman states. However, he takes an honest approach when considering time by stating, “If you’re going to be somewhere for… five years [or more], in my opinion, I think that you should always own.”

Pros and cons are part of most money decisions, and that includes owning vs. renting. R. Gina Renee, HBHA’s English Department Chair and former renter of properties in three states, noted, “[renting doesn’t] accrue any equity whatsoever. All you’re doing is buying time.” The upside to home ownership is that your purchased property gains value as the years progress. Down payments and mortgages do not consume your money the way paying rent does. Opportunities like a home equity line of credit (HELOC) or cash-out refinancing are all financial instruments that allow owners access to assets and the ability to upgrade their home and build a foundation for their home’s worth.

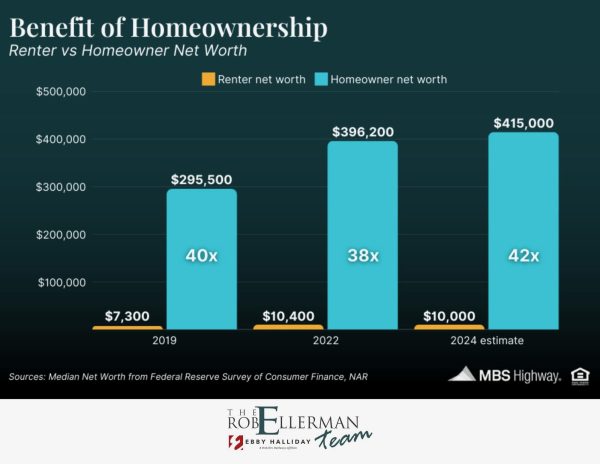

Ellerman explains real estate appreciation, which is the increase in a property’s value over time, influenced by factors like market demand and economic conditions. “If you look at most self-made millionaires in the country, it’s through real estate appreciation over time and its consistency,” Ellerman mentions. In the graph above, the net worth of a renter stays somewhat stagnant and is damaged by the opportunity cost of not owning property.

Possessing a low net worth can lead to financial instability. The lack of assets often leaves renters vulnerable, causing difficulty in avoiding consumer or medical debt and building a strong personal economy. Owning a home promotes the opportunity for someone to slowly grow an asset, which directly allows their net worth to increase. Achieving financial goals, avoiding debt accumulation, and being flexible with costs are all benefits of having a growing net worth.

Since the New Deal era and the creation of the Federal Housing Administration, “homeownership was a mark of respectability,” as according to historian Eric Foner. Homeownership is a goal for many, but it’s often not an easily achieved goal. Renting is an option more applicable and appropriate for one who is “not sure about where they want to live… and it’s not a big commitment,” says Sam Matsil, HBHA’s Athletic Director.

Renting does not require the individual to be “responsible for anything. The benefit of renters insurance also covers damages and additional living expenses,” according to Matsil, which is beneficial and convenient to the renter. Due to the property not belonging to the renter, home maintenance is performed by the property owners, not the renters. However, this can also be a major expense for homeowners, regardless of having homeowners insurance, some of the repair costs will be coming out of their pocket.

Mastil continues to explain the advantages of renting, saying, “If they [your landlord] require you to move out, for let’s say a week, then you receive compensation.” This, among other factors, makes it beneficial for some to choose renting over ownership.

Additionally, it is not optimal for a consumer to buy a house if they are looking for a place to reside for a short period of time. Buying a home typically comes with high costs, such as closing fees, inspections, and a hefty down payment. If a person plans on moving within a year or two, they are unlikely to recover from those costs through appreciation or savings in such a short amount of time. In these cases, renting becomes the more practical and financially sound option, as it offers flexibility without the risk of losing money on a quick resale.

Renting especially benefits those in transitional life stages. These renters prioritize freedom and lower responsibility. They may not have the savings for a down payment or may value mobility over permanence. For such individuals, renting offers peace of mind by removing the burdens of long-term maintenance or the legal obligations of ownership.

What often remains hidden under the excitement of homeownership are the additional, recurring costs that can weigh heavily on new buyers. Homeowners must consider property taxes, which can significantly increase monthly payments, especially in high-demand areas. Homeowners Association (HOA) fees are another potential cost that can range from modest to burdensome, depending on the neighborhood. Maintenance fluctuates depending on the house, and it can be a heavy financial weight.

In conclusion, the debate between renting and owning is not a one-size-fits-all conversation. Both options offer different pros and cons, depending on an individual’s financial situation and goals. While ownership allows for equity growth and long-term financial stability, renting provides flexibility, low risk, and fewer responsibilities. Understanding the full picture, including hidden costs and lifestyle preferences, is key to making a smart and sustainable housing choice.