Fueling a Recession: A Student Perspective on Volatile Gas Prices

October 19, 2022

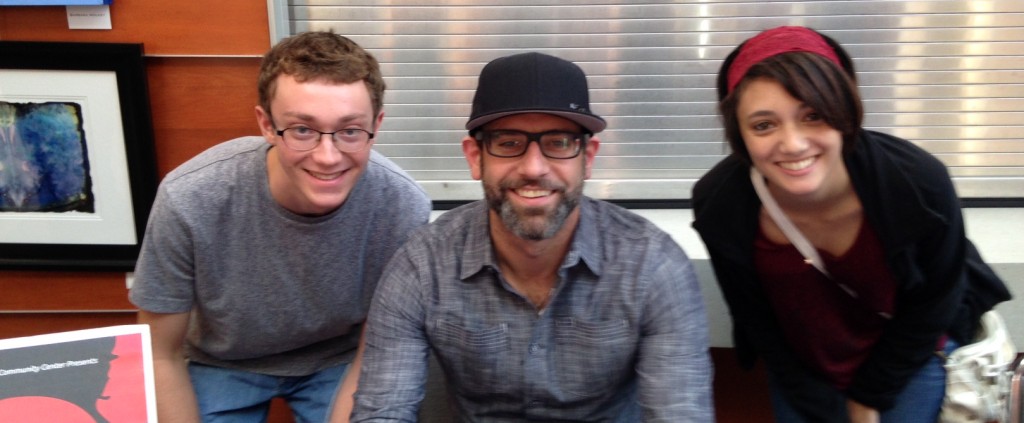

Image by Ethan Sosland.

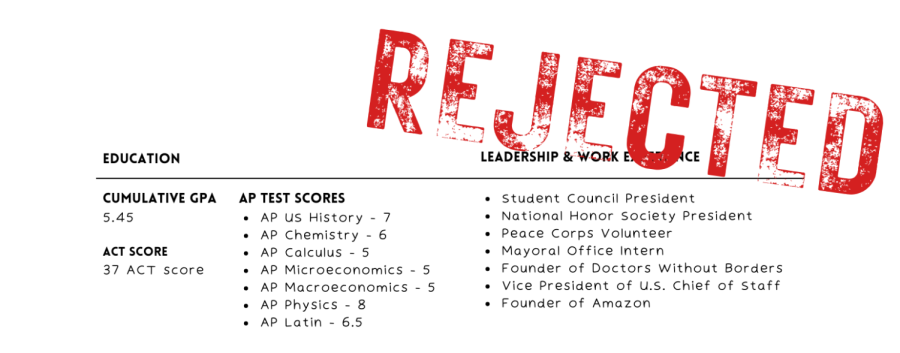

In early June, I had the privilege of taking a road trip through St. Louis and Chicago in search of colleges. Driving such a distance prompted a need to refuel on multiple occasions. Everytime this need arose, I was shocked by the total cost. How could gas stations in the middle of nowhere be charging such a premium for a seemingly infinite resource? Certainly inflation could not be the catalyst for all these events. According to the U.S. Bureau of Labor Statistics, between 2012 and 2021 the inflation rate ranged from 1.8 to 2.6 percent. In 2022, the rate shot up to around 6 percent. Did a year of high inflation rates have an effect on the prices? What was the reason behind such high costs?

Liss explained to me how the crude oil industry functions, as it directly correlates to the price of gas.“Oil is a global market,” Liss states, “It’s set the same all around the world.” He described how the global price is determined; two of them are supply and demand for oil and the quantity of refineries, to convert it to gasoline or other important compounds, in operation. This set price translates to many areas of the commercial world, as most cars require oil for gasoline, airports require oil for jet fuel, and plastic requires oil as a key ingredient in production.

This raised the question: How does one measure the quantity of oil being extracted, and how is this price set? Liss explains that oil is measured by the barrel, which is 42 gallons. The world produces roughly 100 million barrels of oil daily, and the U.S. is the largest of these producers, responsible for about 12 million of them. However, the U.S. is not the only major extractor of crude oil. A group of oil producing powers, called the Organization of the Petroleum Exporting Countries (OPEC), controls a staggering 40 million barrels. OPEC is made up of countries including the United Arabs Emirates, Saudi Arabia, and Russia, meaning conflict among any of these nations can have significant effects on gas prices.

For example, in spring 2022, Russia began an attempted annexation of Ukraine, causing a widespread global outrage. This resulted in the U.S. and many other nations halting the trade of oil with the Russian government. As I learned, the concept of supply and demand is one of the key factors in oil prices, so when supply declined and demand remained constant, prices went up.

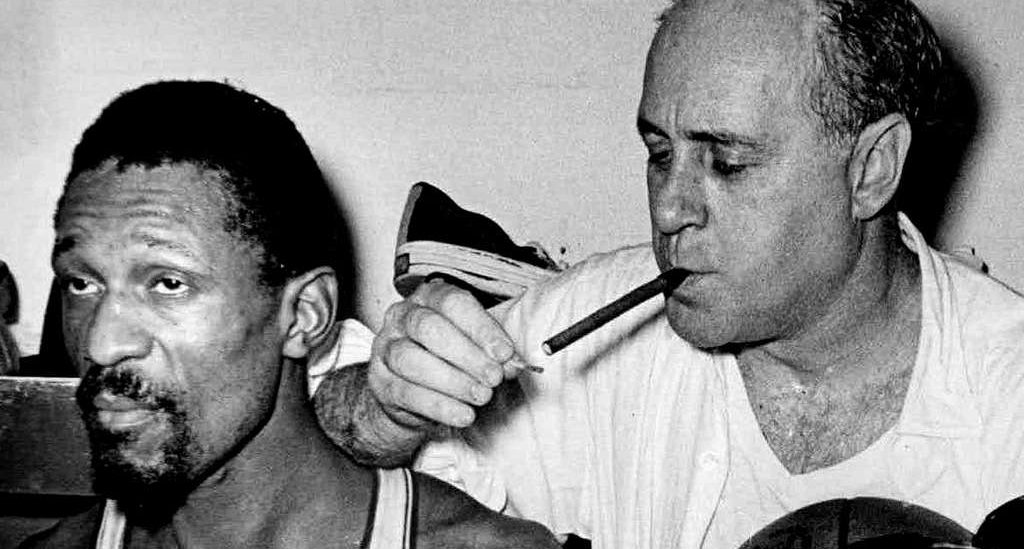

Liss mentioned that a similar situation occurred in the 1970s: Middle Eastern powers refused to export oil to the U.S. due to their support of Israel in the Yom Kippur War. “We didn’t have COVID in the 70s, but we did have something that started a crisis,” Liss says.

But then I wondered, What is the rationale for raising and lowering oil prices besides global conflicts? Liss explains that, unlike the U.S., most countries’ oil reserves are controlled by the government. Therefore, in order for the government to make more money, they need to export oil to other countries.

Still, I questioned: Why don’t countries just set high oil prices? After all, everyone needs oil, so people are certain to pay. Liss explains that “if the price gets too high for too long, what occurs is something called demand destruction.” This basically means that prices become so unreasonable that people are forced to cut oil consumption, increasing shifts from fossil fuels to more sustainable options. Countries will ultimately lose immense sums of revenue from these shifts.

Since these issues are all at the national level, how does this apply to our everyday lives? Liss breaks it down as a chain of events: As oil prices go up, so does the price of plastic, meaning that something as common as a trash bag or a disposable water bottle is now more expensive. As more is spent on these basic necessities, we are forced to spend less money in other areas. As a result, there is a decrease in revenue, so in order to stay profitable, businesses are forced to cut employees. These employees are unable to make purchases they were previously able to with lower prices. They demand a raise at work, and even quit. So, ultimately, if a company wants to maintain employee happiness and can’t afford to lose money, they have no choice but to raise prices and continue the cycle.

Prices spiraling out of control like this is known as a wage-price spiral, which often ends badly. “It’s really hard to arrest [a wage-price spiral],” Liss says. “Usually, the way it comes out is a recession.” In the U.S., this would force the government to raise interest rates high enough that people have no choice but to slow down their spending. Due to present circumstances, Liss mentions that a recession is possible in the near future.

With this knowledge in mind, I decided that in order to truly understand the effects of the prices, I needed to talk to community members who are experiencing it. I spoke with senior Zach Hardy who lives 15 miles away from school and drives a minimum of 30 miles every weekday. Hardy recalls experiencing these high prices. “I remember paying $80 [for gas]” he explains, “that’s almost $160 a month.”

Luckily for Hardy, the money for gas does not come directly out of his pockets, rather, it comes from his parents. This gives him separation from the issue, therefore making the prices “not a big factor” in his political identity, Hardy states.

In contrast, senior Roman Katz is responsible for the cost of his gas, but he shares Hardy’s lack of emphasis on its effect on his political identity. “I don’t think that [U.S.] politics has affected gas prices as much as other people think it does,” Katz says. Instead, he sees the Russia-Ukraine conflict as the main culprit. Katz has seen the effects of gas prices more prominently in his social life, as he now is hesitant in attending events with friends that require significant driving, unless they’re willing to pick him up.

Seeing the issue of gas prices through a different lens has led me to a few key takeaways. First, these prices affect areas far larger than just the money we have to cough up at the gas station, such as plastic productions, shipping, and even wages.

Secondly, I now understand that our world has become so connected that events from thousands of miles away can have massive effects on our lives. Finally, I have learned the important impact history has on the present. As Liss says, “History does not always repeat, but it rhymes.”